Navigating the UK Labour Market in 2023

Fuel Recruitment Insights: The September 2023 UK Labour Market Report Compiled by KPMG and REC have revealed some interesting findings

Key points:

1. Permanent Vacancies: Although Permanent Placements have declined again, it has been at the slowest rate in three months showing a stabilisation. Companies remain hesitant to commit to non-essential permanent hires in times of wider economic uncertainty.

2. Contract / Temp Billings: These returned to growth in September 2023; Companies remain cautious due to economic uncertainty and efforts to control costs. This leads to a preference for higher utilisation of short-term staff rather than permanent heads, leading to a surge in temporary billings. It also indicates a shift towards flexible hiring practices, which can be seen as a positive adaptation by businesses to uncertain economic conditions. It allows them to remain agile and responsive to market changes while still meeting their staffing needs.

3. Pay: Softer Increases in starting pay was noted in September amidst a slowdown in overall pay growth. While starting salaries are still rising, the rate of increase has reached a two-and-a-half-year low. Temporary wages are also increasing at a slower rate. This reflects the delicate balance between attracting talent and managing budget constraints. This will be a relief for businesses who are trying hard to control escalating labour costs, ultimately contributing to financial stability and long-term sustainability.

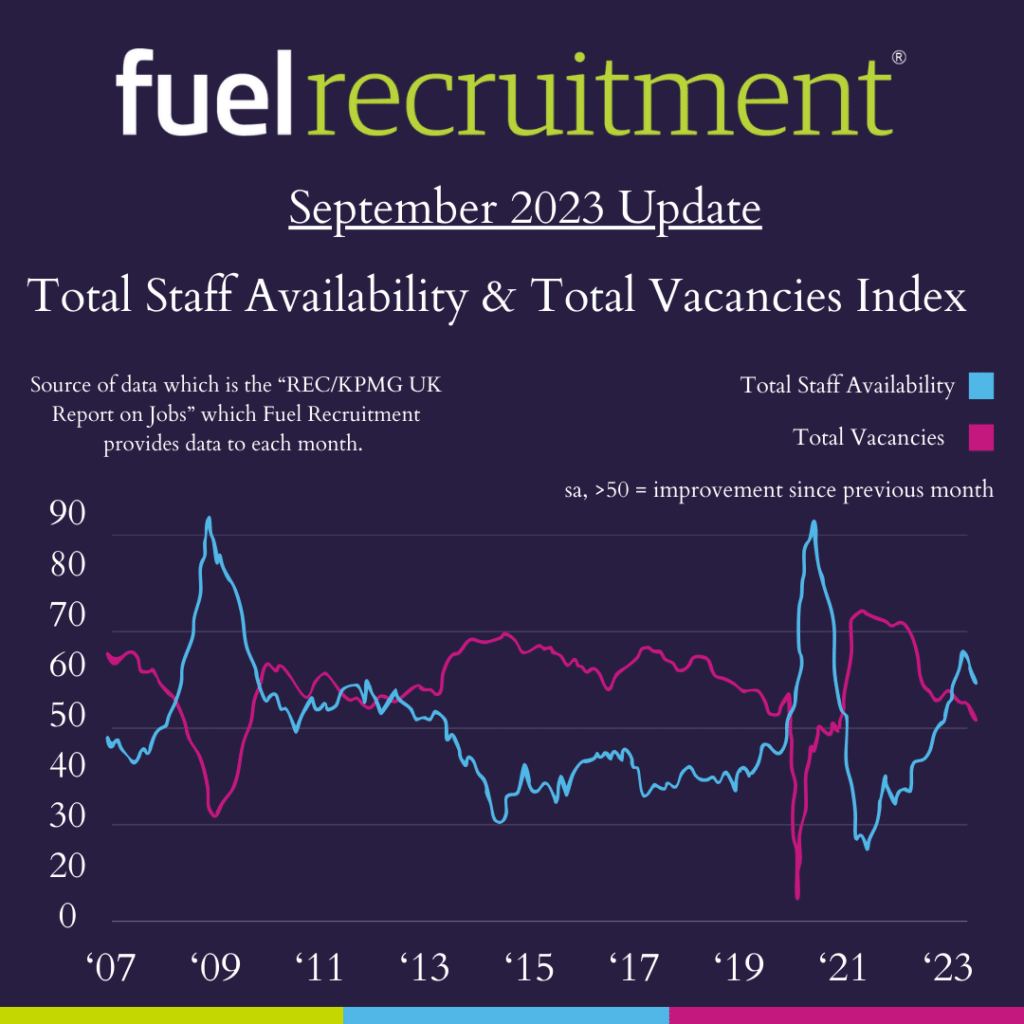

3. Improved Candidate Availability: Candidate availability improved in September, albeit at a slightly slower pace. Both permanent and temporary labour supply increased significantly, attributed to redundancies and market slowdown. From an employer’s perspective, a larger pool of available candidates means greater flexibility in choosing the right fit for their needs. This is a positive development for employers seeking the right talent.

4. Overall Vacancies: For the first time since February 2021, total vacancies declined slightly. Permanent vacancies reduced marginally, while the demand for temporary staff moderated to a four-month low. This shift in vacancy trends reflects the cautious approach of businesses in an uncertain economic environment. It indicates prudent management, ensuring that workforce needs align with current market conditions.

📌 Conclusion The positive aspects lie in the adaptability of UK businesses to economic uncertainties, cost management through controlled pay growth, a larger talent pool for employers, and prudent vacancy management. These trends are indicative of a business landscape that is evolving and making strategic adjustments to navigate through uncertain times.

🔗 Stay connected with Fuel Recruitment for more industry insights and updates on the ever-evolving UK labour market. If you’re looking to navigate these trends effectively, our team is here to help you find the right talent or opportunities to fuel your success.

#FuelRecruitment #UKJobsReport #LabourMarketInsights #RecruitmentTrends #LinkedInInsights #FuelRecruitment

Share This Article

Similar Articles

HR vacancies are on track to increase by up to 50% this year compared to 2024, with…

At Fuel Recruitment, we believe that business success and environmental responsibility should go hand in hand. That’s…

The tech industry is constantly evolving and new skills are always in high demand. As we move…