VacancySoft Insights July 2025

AI and 5G Drive Telecoms Sector Shift

July 2025 Market Update

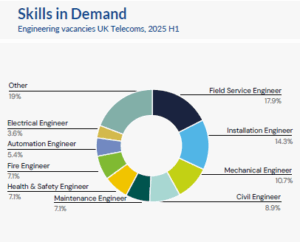

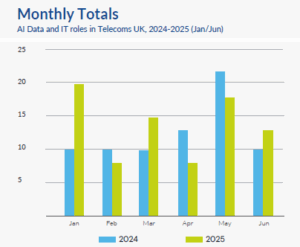

The UK telecoms industry is undergoing a period of accelerated change, driven by AI integration, significant infrastructure investment, and increased collaboration between government, academia, and industry. Fuelled by strategic partnerships and digital transformation initiatives, telecoms companies are pivoting rapidly to meet new technological and operational demands. One of the most prominent initiatives is the Government-backed Federated Telecoms Hubs, launched in 2024. This collaborative programme links leading academic institutions – the Universities of Cambridge and Oxford, Imperial College London, and the University of Bristol ~ via the JOINER platform. Together, they are enabling real-world testing of innovations across AI driven networking, integrated sensing, satellite communications, and quantum security. Notably, Madevo, a spinout from one of the hubs, is developing AI-powered connectivity solutions for crowded environments such as sports stadiums and is currently in discussions with a major US media conglomerate. Elsewhere, university teamsare also investigating the potential for 6G to support secure NHS data transfer and expand telemedicine. Hiring data reinforces the importance of AI to the future of telecoms. Year-on-year, vacancies for AI and data professionals have risen by 9.3%. This upward

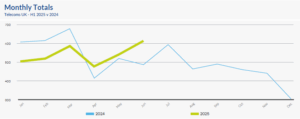

trend reflects broader alignment between the UK Government and private sector actors such as OpenAI, aiming to embed artificial intelligence more deeply across national infrastructure and services. In parallel, spectrum reform is creating new cost-saving opportunities. Ofcom recently announced a £60 million annual reduction in licence fees for legacy spectrum bands, including 900MHz, 1800MHz, and 2100MHz. These savings are expected to be reinvested into expanding 5G coverage and hiring more network specialists. Meanwhile, BT’s £3 billion cost-saving strategy is also reshaping the employment landscape. Having secured £900 million in annualised savings, BT is doubling down on automation and fibre rollout. However, this shift has led to regional job losses: the Midlands has seen a 62% drop in telecoms hiring as full-fibre rollout projects conclude. Nationally, hiring has declined by 35% year-on-year.

licence fees for legacy spectrum bands, including 900MHz, 1800MHz, and 2100MHz. These savings are expected to be reinvested into expanding 5G coverage and hiring more network specialists. Meanwhile, BT’s £3 billion cost-saving strategy is also reshaping the employment landscape. Having secured £900 million in annualised savings, BT is doubling down on automation and fibre rollout. However, this shift has led to regional job losses: the Midlands has seen a 62% drop in telecoms hiring as full-fibre rollout projects conclude. Nationally, hiring has declined by 35% year-on-year.

Despite contraction in some areas, competition is intensifying elsewhere. Virgin Media O2 has acquired 78.8MHz of spectrum from Vodafone-Three in a £343 million deal, boosting its spectrum share to nearly 30%. This move is set to enhance both 4G and 5G

services across its partner networks, including Tesco Mobile, Sky Mobile, and Giffgaff.

CityFibre is also expanding aggressively, securing a £2.3 billion refinancing package (including £500 million in equity from Morgan Stanley and Mubadala). The funds will support the expansion of CityFibre’s 42% fibre-to-the-premises (FTTP) footprint, challenging Openreach’s dominant 57–60% market share. The firm’s partnership with Vodafone-Three aims to bring improved coverage to underserved UK regions. On a regional level, the South of England leads in telecoms hiring, with vacancies rising 16.4% year-on-year – a growth trend supported by the Project Gigabit programme. London follows with 10.8% growth, while Scotland has seen a remarkable 43.4% increase in engineering vacancies since the Vodafone-Three merger announcement.

Cybersecurity demand has also surged, with vacancies reaching a new peak in June 2025. This reflects the growing reliance on AI systems embedded within core telecoms infrastructure, pushing operators to reinforce digital defences. After a slower 2024, overall investment and hiring rebounded in Q2 2025, with hiring volumes up 14.5% compared to the same period last year. Project management roles have seen particular

growth (+18.1% YoY), underlining the need for structured execution of new digital initiatives. Looking ahead, connectivity infrastructure continues to expand beyond telecoms. A major partnership between Network Rail, Neos Networks, and Freshwave will deploy 5,000km of high capacity fibre along key UK rail lines, significantly boosting

4G/5G coverage for passengers by 2026. However, challenges remain. An industry poll revealed that 47% of professionals view the slow 5G rollout as the sector’s top issue,

followed by skills shortages (30%) and regulatory complexity (12%). As telecoms organisations balance innovation with operational constraints, Fuel Recruitment continues to support clients by sourcing the specialist talent they need to lead digital

transformation, infrastructure expansion, and AI integration across the UK.

Please contact the Telecoms Team

Anya Brown – abrown@fuelrecruitment.co.uk

Richard Giles – rgiles@fuelrecruitment.co.uk

Murray West – mwest@fuelrecruitment.co.uk

Efthymios Antoniadis – efthymios@fuelrecruitment.co.uk

About Fuel Recruitment

Fuel Recruitment is a technical recruitment consultancy

with 20+ years of experience in telecoms. We specialise

in placing expert professionals across engineering,

delivery, and digital transformation roles.

Share This Article

Similar Articles

AI and 5G Drive Telecoms Sector Shift July 2025 Market Update The UK telecoms industry is…

Vodafone and Three UK have officially merged to form VodafoneThree, now the UK’s largest mobile network operator,…

Vodafone vacancies have remained consistently strong for the second month in a row, with particularly robust growth…