VacancySoft Insights

HR vacancies are on track to increase by up to 50% this year compared to 2024, with employee relations now the second largest area being recruited for, according to data from Vacancysoft

With the new legislation governing employment passing parliament and set to come into law by the end of the year, will HR departments need to permanently expand as a result? And what will the impact of the new regulations be on how companies hire?

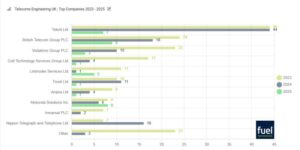

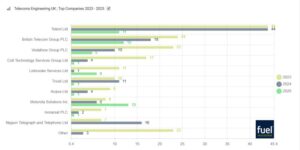

With Telent Technology Services Ltd supporting Openreach’s mission to deliver fibre infrastructure to 20 million UK premises by the mid-to-late 2020s, it’s no surprise the company remained the top hirer in Engineering Telecoms roles last year, even as most others froze hiring. The biggest surge came from Nippon Telegraph and Telephone, where vacancies more than doubled.

With companies like NTT expanding their UK presence and demand for advanced telecom solutions continuing to grow, which company do you think will make the biggest leap in 2025?

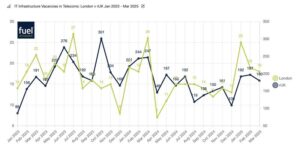

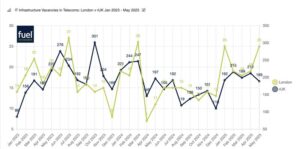

IT Infrastructure vacancies in Telecoms rose significantly in Q1, hitting levels not seen since the first half of last year, both in London and across the rest of the country.

London has increased its share of infrastructure vacancies also. Over the period 8% of the roles were in the capital, whilst in Q1, this had risen to 9.8%. This then begs the question, why has there been a greater focus in London so far this year?

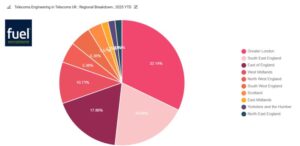

With County Broadband’s plans to extend full-fibre networks to 500,000 premises across the East of England by 2027, recruitment for Telecoms Engineering roles in the region has surged so far this year.

As a result, it is the fastest growing part of the country in terms of telecoms engineering vacancies this year, making up 17.9% of the national total in 2025 so far, compared to 5.5% in 2024.

With that, if you would like to know more about the activity we are seeing in the market, get in touch.

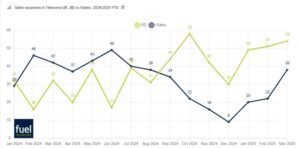

Business Development roles in Telecoms have surged in 2025, with nearly 93% more vacancies than the rest of the Sales division combined. Meanwhile, other Sales roles have declined but appear to be recovering this month.

With major players like BT, Vodafone, and Virgin Media O2 competing for market share and rapidly expanding 5G infrastructure to meet growing demand, could this be fueling a greater need for BD professionals?

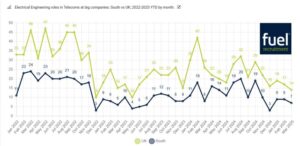

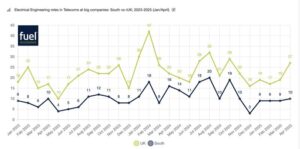

Data from Vacancysoft shows the demand for Electrical Engineers in larger firms across Southern England surged in 2024, hitting levels last seen in the peak post pandemic period in 2022.

However, since then, activity has tailed off. Equally with the 5G installation roadmap now taking shape and Huawei targeted to be fully removed by 2027, could demand for Electrical Engineers even surpass 2022 activity levels?

N.B. Data visualised is based on electrical engineering vacancies published on large company websites.

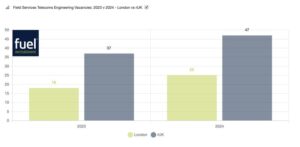

Permanent vacancies for field services telecoms engineers increased by 31% in 2024 as Vodafone and EE both completed their 3G network switch-off. The uplift was slightly faster in London than the rest of the country, up by 39% compared to 27% in the rest of the country.

Anyway, with Virgin Media O2 now looking to begin their switch off in 2025, and all the networks looking to maximise their 5G coverage, what will this mean for demand for Field Services telecoms engineers this year? Will London continue to see demand grow the fastest, or will another region see demand for field services engineers surge this year?

Let us know your thoughts below!

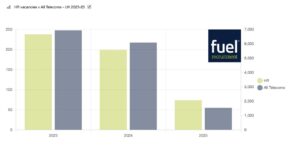

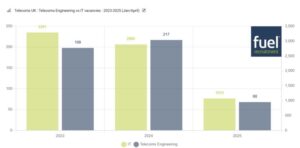

Telecoms Engineering vacancies rose last year as demand for IT fell. As 3G becomes discontinued, the move to 4G/5G accelerates, what will this mean for the sector in 2025? Thoughts welcome!

IT infrastructure vacancies in London have surged by 31% over the past month, while regional vacancies saw a modest decline of 10%. Despite this dip outside the capital, overall vacancy levels remain high and are on track to surpass 2024 figures.

This upward trend is driven by significant investment from telecom providers in 5G networks, fibre broadband, and cloud-based services. These initiatives are creating strong demand for skilled professionals, including network engineers, infrastructure architects, and cloud specialists, to modernize legacy systems and implement next-generation technologies.

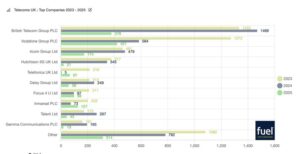

Despite experiencing a 54% drop in vacancies last year, Vodafone has rebounded strongly and is now on course for a 68% increase, making it the telecom company with the highest number of vacancies this year. This resurgence likely reflects renewed investment in infrastructure, digital services, and a shift in strategic priorities following internal restructuring. BT Group follows closely behind but is expected to face a 39% decline in vacancies. Other notable companies showing strong growth include Telefónica, Inmarsat, and Focus Group.

IT Security vacancies in the telecom sector have rebounded strongly, showing a 43% increase since the beginning of the year. In comparison, the broader private sector has seen a more modest 13% rise in cybersecurity roles over the same period.

With a surge in cyber threats – BT Group, for example, reports facing around 2,000 potential attacks every second, and new legislation heightening the sector’s focus on cybersecurity, is the demand for these roles set to grow even further in the coming months?

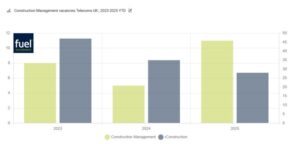

Construction Management roles in Telecoms have risen by 45% this year, already surpassing 2024 levels, according to data from Vacancysoft. This upward trend is also evident across other construction-related positions.

As the UK pushes forward with major telecoms infrastructure projects, such as the rollout of full-fibre broadband and 5G – requiring significant construction efforts, could this be driving the surge for construction management professionals?

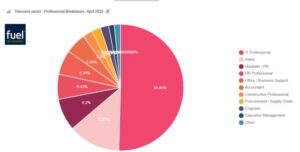

IT roles in Telecoms saw a resurgence last month, with a reported 18% increase, now accounting for over half of all vacancies in the sector.

Meanwhile, other areas have declined – Sales roles dropped by 18%, and Marketing by 36%, with Marketing in particular experiencing a 5% decrease in market share.

Given these trends, the question is: Are we witnessing a sustained shift toward IT role dominance, or is this just a temporary adjustment?

Telecoms vacancies in London continue creeping upwards, seeing 29% growth since February. Vacancies in the North also remain elevated, seeing 33% growth since the start of the year.

As companies are ramping up recruitment for roles in network architecture and engineering to support ongoing 5G rollouts and infrastructure upgrades., and comopanies like BT Group is investing in the region by adding 70 new apprentice and graduate positions across Manchester, Warrington, and Accrington, could we see the hiring trend continue?

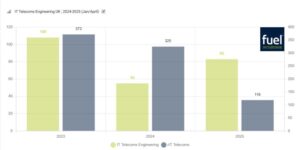

IT Telecoms engineering roles saw a 49% drop last year, but vacancies have already surged past 2024 levels, climbing by 51% this year.

With the rollout of 5G and full-fibre networks underway, along with major infrastructure investments, it’s no surprise demand is rising. But could there be other factors driving this growth?

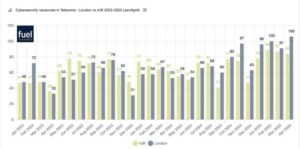

𝗖𝘆𝗯𝗲𝗿𝘀𝗲𝗰𝘂𝗿𝗶𝘁𝘆 𝗗𝗲𝗺𝗮𝗻𝗱 𝗶𝗻 𝗧𝗲𝗹𝗲𝗰𝗼𝗺𝘀 𝗿𝗶𝘀𝗲𝘀 𝗯𝘆 𝟰.𝟰%

With telecoms being prime targets for cyber threats, the rollout of 5G introducing new vulnerabilities, and regulatory pressure intensifying, cybersecurity vacancies are increasing once more with activity surging in April in London specifically.

With that, interestingly in London, volumes rose month on month by 16.5%, whereas regionally activity dropped off slightly, down 3.4%. Equally, the regional dip is likely to just be a blip, given that when looking at a rolling 12 month period, vacancies have increased by 2.7% overall.

While hiring for Electrical Engineers in Telecoms across the South has stabilised following a period of decline, national demand has surged by up to 70% in the past month.

With 5G networks expanding rapidly and major investment flowing into full-fibre broadband across the UK, regional demand is expected to rise again soon.

While Tech vacancies in Telecoms dropped by 12% last year, they are projected to grow by 11% this year, even as demand for telecoms engineering roles slows.

With the race to roll out 5G accelerating, AI reshaping operations, and mounting cybersecurity pressures, could we see a surge in tech vacancies in the months ahead?

In May 2024, the UK Home Office extended Motorola Solutions‘ $748 million Airwave TETRA contract through 2029. To support it, the company has ramped up hiring, now leading the Telecoms sector in Engineering vacancies.

With strong demand for 5G rollout and network expansion, along with the company’s announcement of a new research and development center in Ireland, could vacancies at Motorola Solutions continue to rise?

Share This Article

Similar Articles

HR vacancies are on track to increase by up to 50% this year compared to 2024, with…

At Fuel Recruitment, we believe that business success and environmental responsibility should go hand in hand. That’s…

The tech industry is constantly evolving and new skills are always in high demand. As we move…